This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies Find out more here

Category : Banking

PSU Insurers Lead Decline in Non-Life Premiums for September

The non-life insurance industry witnessed a 7% YoY decline in premiums for September 2024, led by public sector insurers' underperformance....

Zarin Daruwala to Retire as Standard Chartered India CEO...

Zarin Daruwala, CEO of Standard Chartered India and South Asia, will retire on April 1, 2025, after eight years of leadership. The...

RBI Raises Transaction Limits for UPI 123Pay and UPI Lite...

The RBI has increased the transaction limits for UPI 123Pay and UPI Lite, promoting financial inclusion and wider digital payments...

ICICI Bank Collaborates with PhonePe to Offer Instant UPI...

ICICI Bank partners with PhonePe to offer instant UPI credit to pre-approved customers, enhancing the ease and convenience of digital...

RBI Maintains Repo Rate at 6.5%: Home Loan Borrowers Face...

RBI maintains the repo rate at 6.5%, delaying EMI relief for home loan borrowers. Rising property prices and stable loan rates impact...

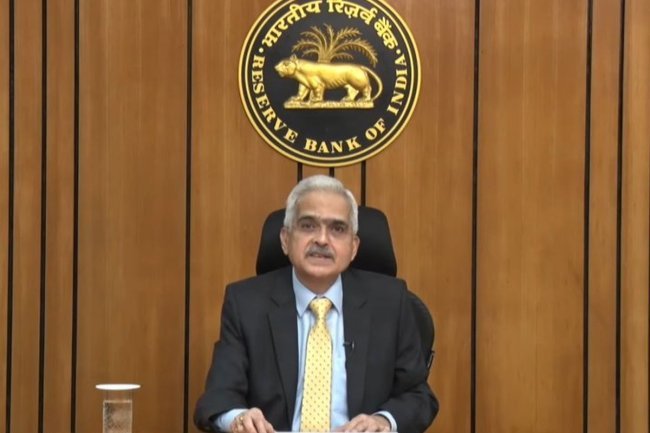

RBI Holds Repo Rate Steady at 6.5 percent Governor Shaktikanta...

The RBI's Monetary Policy Committee, led by Governor Shaktikanta Das, decided to maintain the repo rate at 6.5% for the tenth consecutive...

HDFC Bank Board Approves 100% Stake Sale of HDFC Education...

HDFC Bank has approved the sale of its 100% stake in HDFC Education to Vama Sundari Investments for ₹192 crore. The sale will be executed...

NBFCs Turn to NCD Market as RBI Tightens Bank Credit

NBFCs in India have significantly increased their reliance on non-convertible debentures (NCDs), raising ₹34,490 crore in September...

UPI-Linked Credit: How Banks Can Lead the Pay Later Market...

UPI-linked credit is poised to revolutionize India’s Pay Later market by offering a low-cost, convenient alternative to traditional...

Home Loan Customers May Need to Wait Until December for...

Home loan borrowers hoping for lower EMIs may need to wait until December 2024, as the RBI is expected to delay repo rate cuts until...

RBI to Hold Government Bond Buyback Auction Worth Rs 25,000...

The RBI will conduct a bond buyback auction on October 10, offering to repurchase Rs 25,000 crore worth of government securities maturing...

Bank Credit Offtake and Deposit Growth Slow Down in First...

Bank credit offtake and deposit growth in India slowed significantly during the first half of FY25, with credit growth dropping to...