RBI Proposes New Guidelines to Ringfence Banks' Core Businesses and Limit Non-Core Activities

The RBI has proposed new guidelines to limit banks’ non-core activities and ensure they focus on their core businesses. The draft circular suggests capping a bank’s equity investments in group entities and other companies at 10% of its paid-up share capital. It also aims to prevent overlaps in lending activities and curb banks from using group entities to bypass regulations. Major banks like HDFC Bank and ICICI Bank could be impacted by these changes, particularly in their non-bank lending arms.

RBI Proposes New Guidelines to Ringfence Banks' Core Businesses and Limit Non-Core Activities

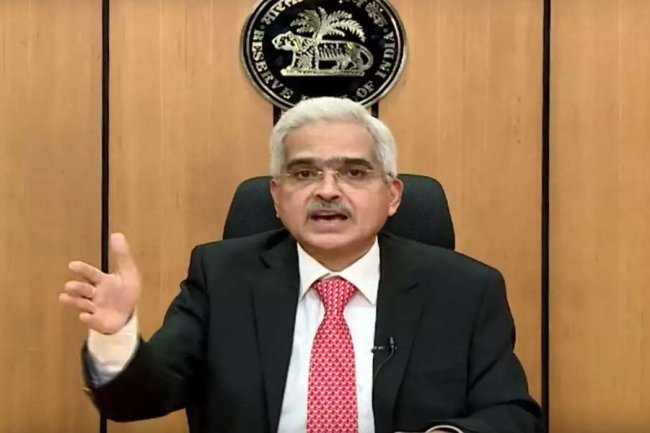

The Reserve Bank of India (RBI) has issued a draft circular proposing stringent guidelines for banks to ringfence their core business operations from risk-bearing non-core activities. The central bank has asked large banks to reassess their operations, including investments in group entities and other financial or non-financial services companies, in order to prevent overlaps and conflicts between their core and non-core businesses.

The draft circular, titled Forms of Business and Prudential Regulation for Investments, suggests that only one entity within a banking group should conduct a specific form of business. It also mandates that no overlap in lending activities should occur between a bank and its group entities. The guidelines are designed to prevent banks from using group entities to bypass existing regulations.

The RBI also plans to impose stricter norms on equity investments by banks. Under the draft rules, a bank’s investment in any company, including group entities, will be capped at 10% of the bank’s paid-up share capital and reserves. Additionally, total equity investments in all companies, including overseas investments, will be limited to 20% of the bank’s paid-up share capital and reserves.

These changes are expected to affect major banks like HDFC Bank, ICICI Bank, and Federal Bank, especially in terms of their non-bank lending arms.

Further restrictions include a cap of 10% on bank holdings in deposit-taking NBFCs, though this does not apply to Housing Finance Companies. Banks will also be limited to holding no more than 20% in any non-financial services company, with exceptions allowing for up to 30% under certain conditions.

The RBI draft circular also restricts banks to sponsoring only one Asset Reconstruction Company (ARC) at a time, with bank group shareholdings in ARCs capped at less than 20%. Moreover, the RBI stressed that banks should carefully evaluate risks associated with equity investments in Alternative Investment Funds.

Click Here to Visit

What's Your Reaction?