RBI Governor Warns of Financial Stability Risks Due to Over-Reliance on AI in Banking

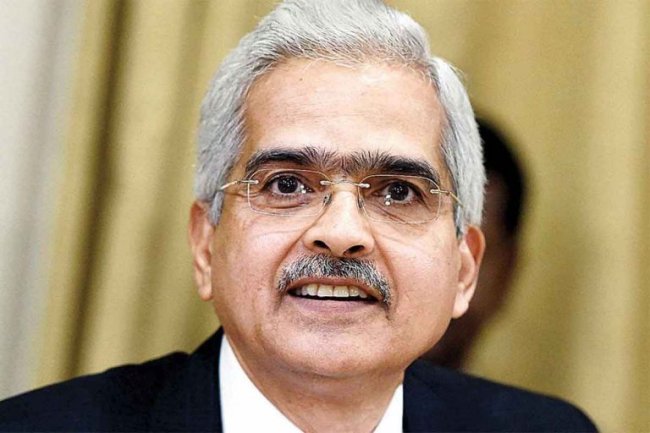

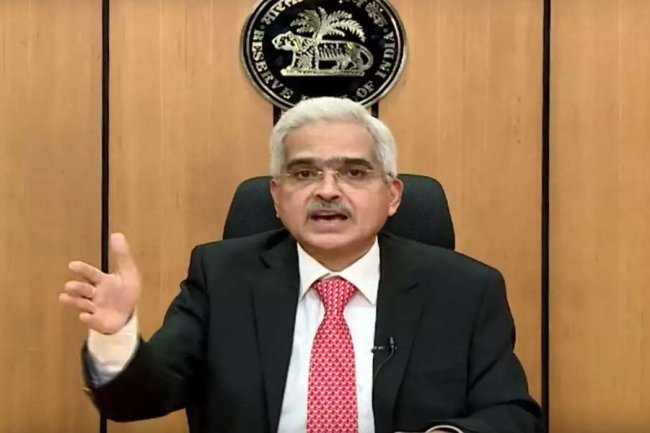

RBI Governor Shaktikanta Das warns of the financial stability risks posed by over-reliance on AI in the banking sector, calling for stronger risk mitigation measures. He also highlights the importance of managing liquidity risks in a rapidly digitalizing financial landscape.

RBI Governor Warns of Financial Stability Risks Due to Over-Reliance on AI in Banking

RBI Governor Shaktikanta Das has issued a warning to banks about the growing integration of artificial intelligence (AI) in financial services, highlighting its potential to introduce significant financial stability risks. Speaking at a conference organized by the RBI in Delhi, Das emphasized the need for banks to implement robust risk mitigation strategies to address the vulnerabilities posed by increasing reliance on AI and BigTech.

According to Das, the heavy reliance on AI in the financial sector could lead to concentration risks, particularly when a limited number of tech providers dominate the market. This dominance could amplify systemic risks if a disruption occurs in any of these systems, potentially causing failures that ripple across the entire sector. "The heavy reliance on AI can lead to concentration risks, especially when a small number of tech providers dominate the market. This could amplify systemic risks, as failures or disruptions in these systems may cascade across the entire financial sector," Das cautioned.

He further explained that the use of AI introduces new vulnerabilities, including a heightened risk of cyberattacks and data breaches. Moreover, the opaque nature of AI algorithms makes it challenging for regulators and institutions to audit or interpret how decisions are made, increasing the potential for unpredictable market outcomes. “AI’s opacity makes it difficult to audit or interpret the algorithms which drive decisions. This could potentially lead to unpredictable consequences in the markets,” Das noted.

To manage these risks, Das urged banks to balance the advantages of AI and BigTech while ensuring they maintain control over their operations. "In the ultimate analysis, banks have to ride on the advantages of AI and BigTech and not allow the latter to ride on them," he stated.

Das also addressed the risks of misinformation and rumors spreading through social media, particularly in today’s digital landscape where online banking and instant money transfers are widespread. He cautioned that these factors could create liquidity stress for banks, urging them to stay vigilant in the social media space and enhance their liquidity buffers.

In line with these concerns, the RBI has proposed new norms for liquidity coverage ratios (LCR) in a draft circular issued in July. The proposal suggests increasing the run-off factor for retail deposits, which accounts for the likelihood of depositors withdrawing funds unexpectedly. This adjustment reflects the growing number of internet and mobile banking users, whose behavior could pose greater liquidity risks.

According to the proposed guidelines, stable retail deposits enabled with internet and mobile banking (IMB) will have a 10% run-off factor, while less stable deposits will face a 15% run-off factor. These changes are designed to safeguard banks from sudden withdrawals, ensuring that they maintain adequate liquidity in the face of evolving digital banking trends.

The proposed measures underscore the RBI’s efforts to address the potential risks that arise from the intersection of advanced technologies like AI and digital banking, while ensuring the financial system remains resilient.

Click Here to Visit

What's Your Reaction?