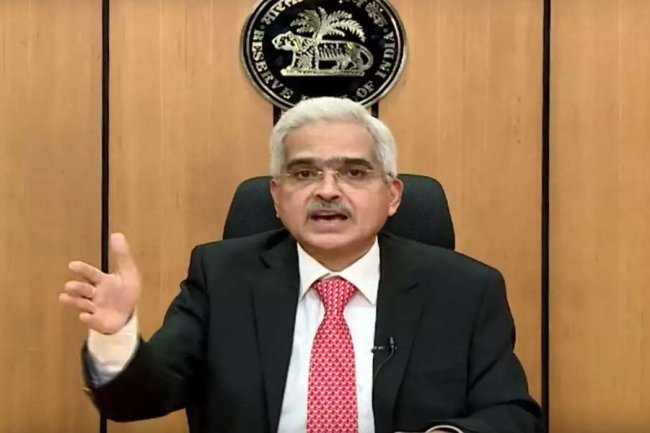

RBI Investigates Foreign Investors' Exit from Indian Bond Derivatives Amid Rising Concerns

The Reserve Bank of India is investigating the unwinding of foreign investors' long positions in Indian bond derivatives as over Rs 1400 crore has been withdrawn from Fully Accessible Route securities. This trend has raised concerns amid significant foreign outflows from domestic equity markets leading to record lows for the Indian rupee. RBI officials have engaged with foreign banks to understand the negative outlook on Indian bonds while assessing the potential impact on financial stability.

RBI Investigates Foreign Investors' Exit from Indian Bond Derivatives Amid Rising Concerns

The Reserve Bank of India (RBI) is closely monitoring the situation as foreign investors unwind their long positions in Indian sovereign debt through proxy derivative instruments. This trend has raised concerns within the central bank as it has led to significant movements in the bond market, impacting overall financial stability.

Recent reports indicate that these foreign investors have withdrawn over Rs 1,400 crore (approximately $167 million) on a net basis from Fully Accessible Route (FAR) securities in just three trading sessions. This rapid unwinding has resulted in net sales of Rs 200 crore so far this month. The impact of these withdrawals is compounded by a broader trend of over $8 billion in foreign outflows from domestic equity markets in October. The combination of these factors has contributed to the Indian rupee hitting record lows, prompting the RBI to take action.

In response to these developments officials from the RBI's financial markets department have reached out to foreign banks that have reduced their positions in FAR securities. According to traders who spoke on the condition of anonymity due to their lack of authorization to speak to the media the RBI's inquiries focused on understanding the negative outlook on Indian bonds expressed by these banks and gathering feedback on the unwinding of substantial positions.

While the RBI officials have sought clarification on these foreign investors' actions they have not issued any specific instructions or directives. The RBI's engagement with foreign banks indicates its concern about the potential implications of these actions on the Indian bond market and the overall economy.

The movement of foreign capital is crucial for maintaining the liquidity and stability of the Indian financial markets. The recent trend of outflows raises questions about investor confidence and the future outlook for Indian bonds amid changing global market conditions. Analysts suggest that such developments may have long-term implications for foreign investment in India as market participants closely monitor the situation.

As the RBI continues to assess the situation and gather insights from foreign banks it remains to be seen how these dynamics will unfold and what measures if any will be implemented to stabilize the bond market and strengthen investor sentiment moving forward.

Click Here to Visit

What's Your Reaction?