Banks Face Challenges in Mobilizing Large Deposits as C-D Ratio Reaches 80 Percent

Banks Face Challenges in Mobilizing Large Deposits as C-D Ratio Reaches 80 Percent

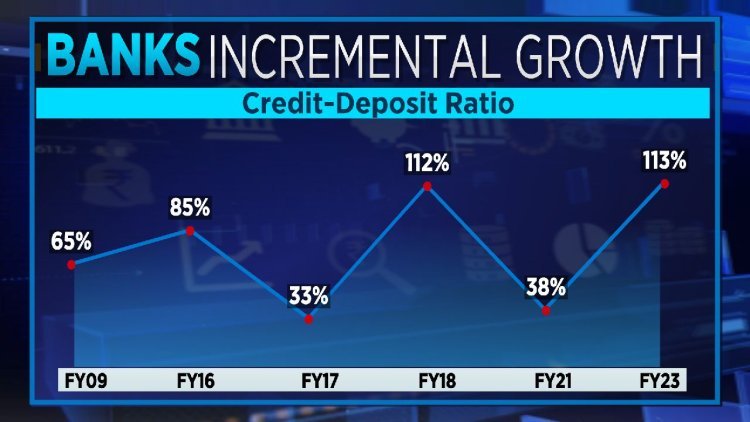

A recent report reveals that banks have struggled to mobilize large deposits to meet rising credit demand over the past two financial years. Outstanding credit disbursed by Scheduled Commercial Banks reached a record high of 164.98 trillion rupees in 2023-24, with the Credit-to-Deposit (C-D) ratio increasing from 75.8 percent to 80.3 percent, according to Infomerics Ratings.

The Reserve Bank of India’s April 2024 Bulletin indicates that the incremental Credit-Deposit Ratio (ICDR) was approximately 95.94 percent in March 2024, up from 92.95 percent earlier in the month. This highlights a significant growth in credit compared to deposit accumulation, particularly on a quarter-on-quarter basis.

The report attributes the slower deposit growth to alternative investments and substantial cash holdings in the unorganized sector, especially in rural areas. Additionally, it notes a rising trend among younger investors, with those under 30 years old increasing their share of the registered investor base from 22.6 percent in FY19 to 39.9 percent as of July 31, 2024. Meanwhile, the share of investors aged 30-39 remained stable, while those over 40 saw a decline.

To improve the deposit ratio, True North Financial Services CEO Rochak Bakshi emphasizes the need for collaboration between banks and the government. He advocates for a return to the historical strength of raising small-ticket deposits from the retail public rather than focusing on bulk corporate deposits. Bakshi also points out that 47 percent of term deposits are held by senior citizens, suggesting a lack of interest in bank deposits among the younger generation.

He recommends that the government consider reducing taxes on interest income, particularly for those in the highest tax bracket, and suggests shifting taxation to the time of maturity for fixed deposits instead of taxing yearly accruals.

Click Here to Visit

What's Your Reaction?