67% of Equity Mutual Funds Beat Benchmarks in August: Performance Breakdown by Category

67% of Equity Mutual Funds Beat Benchmarks in August: Performance Breakdown by Category

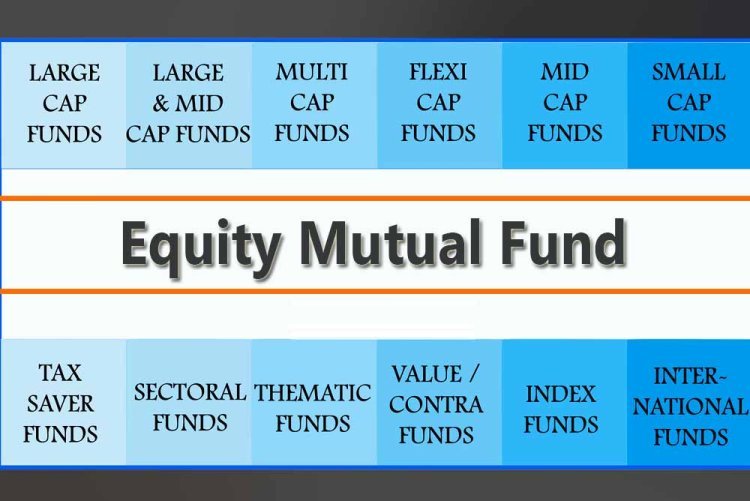

In August 2024, 67% of equity mutual funds managed to outperform their respective benchmarks, showcasing a strong performance across various fund categories. According to recent data, the Assets Under Management (AUM) of equity mutual funds grew by 2.04% during the month, rising from ₹25,12,846 crore in July 2024 to ₹25,64,069 crore in August 2024, marking continued investor interest in equity markets. This growth excludes sectoral and thematic funds.

Performance Snapshot

A comprehensive analysis of 283 open-ended equity diversified mutual funds was conducted, revealing that 190 of these funds managed to outperform their benchmarks by the end of August 2024. This marks a strong showing, as more than two-thirds of the equity mutual fund schemes provided better returns compared to their respective market indices.

Category-wise Performance:

-

Large & Mid Cap Funds: These funds emerged as the top performers in August, with 79% of the schemes in this category outperforming their benchmarks. The strong performance in this category is likely attributed to the balanced exposure to both large-cap stability and mid-cap growth potential.

-

Focused Funds: Focused funds, which typically invest in a concentrated portfolio of stocks, saw 75% of schemes outperforming their benchmarks. The focused approach allowed these funds to generate superior returns by concentrating investments on fewer, high-conviction stocks that performed well during the month.

-

Multi Cap, Mid Cap, and Flexi Cap Funds: These categories each saw 69% of their schemes outperforming their respective benchmarks. Multi-cap funds benefit from diversification across market capitalizations, while mid-cap funds take advantage of the higher growth potential of mid-sized companies. Flexi-cap funds, with their ability to shift between large, mid, and small-cap stocks, also demonstrated strong performance.

-

Large Cap Funds: On the other end of the spectrum, large-cap funds lagged behind other categories. Only 55% of schemes in this segment managed to surpass their benchmarks. Large-cap stocks, which are often more stable but less volatile, showed less movement compared to mid- and small-cap stocks, which may have led to the lower outperformance rate in this category.

Insights Behind the Performance

-

Market Conditions: August 2024 saw robust market conditions, with broader indices trending upward due to strong corporate earnings reports, favorable economic data, and positive investor sentiment. Mid-cap and multi-cap stocks, in particular, benefited from higher investor interest as they offer higher growth potential in a booming market.

-

Diversification and Stock Selection: Fund managers that focused on well-diversified portfolios, as seen in large & mid-cap and multi-cap categories, were able to capitalize on the performance of high-growth mid-cap stocks while maintaining a cushion with stable large-cap investments. The ability to tactically switch between stock categories allowed these funds to outperform their benchmarks.

-

Large-Cap Underperformance: The relatively lower outperformance in the large-cap segment can be attributed to the stability of large-cap stocks, which tend to be less volatile compared to their smaller counterparts. During periods of market rallies, mid and small-cap stocks tend to outperform large caps due to their higher growth potential, explaining why large-cap funds saw fewer schemes beating their benchmarks.

AUM Growth and Investor Sentiment

The overall increase in AUM of 2.04% in August highlights the growing confidence of investors in equity mutual funds. Despite the varying performances across categories, the sector as a whole continues to see healthy inflows, driven by rising stock markets and attractive returns offered by equity schemes.

Equity mutual funds continue to be a preferred investment option for retail investors, with Systematic Investment Plans (SIPs) contributing significantly to the sustained growth in AUM. The ongoing economic recovery and growth in corporate earnings have boosted the equity market, creating a favorable environment for equity mutual funds to thrive.

Click Here to Visit

What's Your Reaction?