50 New Payment Apps Set to Join UPI Ecosystem Despite Zero MDR, Says NPCI CEO

NPCI CEO Dilip Asbe reveals 50 new payment apps are eager to join the UPI platform despite the absence of an MDR. He also discusses future possibilities of MDR for large merchants and efforts to balance the UPI market dominated by PhonePe and Google Pay.

50 New Payment Apps Set to Join UPI Ecosystem Despite Zero MDR, Says NPCI CEO

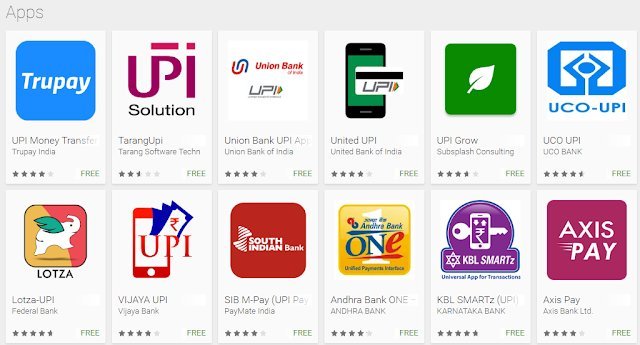

Despite the absence of a merchant discount rate (MDR) on UPI transactions, the ecosystem is witnessing a surge in interest from third-party application providers (TPAPs), with 50 new payment apps keen on joining the platform, according to Dilip Asbe, Managing Director and CEO of the National Payments Corporation of India (NPCI).

In an interview with MoneyControl, Asbe highlighted that the lack of a clear revenue model initially slowed the entry of new players into the UPI ecosystem. However, the past year has seen a significant uptick in participation. “We have seen the highest number, with almost 50 new TPAPs wanting to enter the market. As new players come in, existing ones are also stepping up investments,” Asbe said.

New players like Navi, BharatPe, and super.money are among those entering the UPI space in recent months. Currently, most UPI transactions, especially debit transactions, remain free, with payment processing costs borne by fintech companies and banks.

Asbe also indicated that there could be a future possibility of MDR being applied to UPI transactions, but only for larger merchants with turnovers exceeding ₹20 lakh. Smaller merchants would remain exempt from such charges. “If MDR comes in, it would be for larger merchants, not for smaller ones,” Asbe added.

An MDR on UPI transactions would allow companies to generate revenue from processing digital payments, thereby alleviating the financial burden of covering payment processing expenses.

On concerns regarding the duopoly of PhonePe and Google Pay, which handle 87% of UPI volumes, Asbe said the market would eventually balance out with new use cases, such as credit products like credit card on UPI and credit line on UPI. While a 30% market cap on TPAPs was proposed by NPCI in November 2022, the decision is still pending.

In the meantime, NPCI is leveraging artificial intelligence (AI) for risk and fraud management, including anti-money laundering (AML) advisories, managing mule accounts, and using data science to enhance the security and efficiency of UPI operations.

Click Here to Visit

What's Your Reaction?