PNB Reports 137 Percent Q2 Profit Surge Plans Wealth Management Arm for HNIs Amid Strong MSME Focus

PNB reports 137% rise in Q2 net profits, driven by strong MSME lending and efficient risk management. CEO Atul Kumar Goel reveals plans for a new wealth management arm to serve high-net-worth clients amid strategic focus on selective MSME exposure.

PNB Reports 137 Percent Q2 Profit Surge Plans Wealth Management Arm for HNIs Amid Strong MSME Focus

Punjab National Bank (PNB) reported robust financial results for the second quarter of FY25, with net profits soaring by 137% to ₹4,714 crore. In a discussion with FE, PNB’s Managing Director and CEO, Atul Kumar Goel, outlined the bank’s plans to expand its wealth management services for high-net-worth individuals (HNIs) and provided insights into PNB’s MSME lending strategies.

Goel addressed the potential impact of shifting interest rates on PNB’s margins, noting that around 48% of PNB’s lending book is linked to the repo rate or T-bill. While this linkage allows for flexibility in response to rate adjustments, Goel acknowledged that a rate cut could exert pressure on margins, as deposits may not immediately follow the rate change. However, with a large base of savings deposits, the bank has some margin control flexibility.

PNB also reported a significant decrease in new provisions and contingencies. Goel attributed this to meticulous underwriting, highlighting that PNB has disbursed ₹8.19 lakh crore out of ₹9 lakh crore sanctioned over the past 51 months. With strong risk management measures in place, PNB has maintained an NPA rate of only 0.29% in this book.

MSME and agricultural accounts currently hold the highest share of PNB’s stressed loans. Goel noted that the bank’s strategy involves selective lending, or “cherry-picking,” within the MSME sector to ensure high-quality loan performance. With a ₹1.5 lakh crore exposure to MSMEs, predominantly in the AAA category, the bank expects minimal risk in this segment.

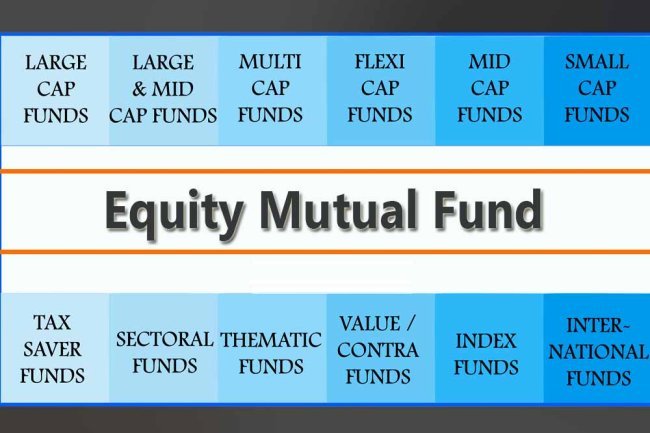

The bank also declared MTNL as a non-performing asset (NPA) in September, which Goel admitted would impact margins but assured discussions are ongoing for resolution. Additionally, to cater to affluent clients and HNIs, PNB plans to launch a dedicated wealth management division. This unit would extend the financial facilities already available on the bank’s mobile app to a specialized wealth management service.

Click Here to Visit

What's Your Reaction?